What is the best jurisdiction to incorporate a VC-backable LATAM-based startup?

By: Pedro Cecilio

DISCLAIMER — This is not legal advice; we at Newlin Ventures wrote this article for informational purposes only; you should not rely on any of the information contained here as true, legal, recommendation, endorsement, financial, or any other type of advice.

Introduction

At Newlin Ventures, we are working hard to establish ourselves as the first choice of institutional check for LATAM-based founders who wish to expand into the US — since 2022 we have already invested in 2 deals in Latin America and our pipeline in the region is hot!

Due to the geographical scope of our thesis, we are frequently exposed to ventures in Latin America. Therefore, we started to study and analyze different legal structures that startups based in the region should adopt to maximize the benefits for all stakeholders in an investment.

Preferably, ventures based in LATAM should adopt a structure known as the Cayman-Delaware Sandwich, a formation created by Kaszek Ventures ten years ago which has been used by leading VCs worldwide to ensure the highest legal protection and the lowest tax burden for founders and investors, this structure has since evolved into the industry standard for Latin American startups seeking global capital.

In fact, as of 2022 a whopping 47.7% of all LatAm unicorns have a Cayman Islands Holding as part of their company structure

— Latitud

Learn more!

An overview of the legal structure favored by VCs

To avoid the risk of the legal liabilities associated with investing in a LATAM-based company, global VC funds typically require startups to incorporate in the United States, in the state of Delaware — if a founder refuses to adopt this structure, the funds can raise a red flag and withdraw their commitment.

To summarise, a Delaware-based structure is advantageous because it is a tax-friendly state with simple laws and a Court of Chancery that is well-known among lawyers and investors for its effectiveness in resolving disputes.

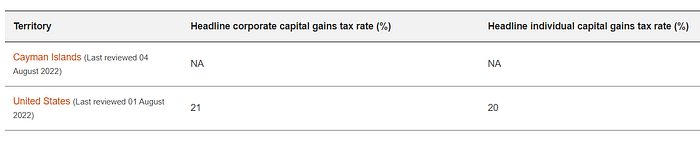

However, there are significant disadvantages to relying solely on a Delaware (USA) based structure; the major problem in Delaware incorporation is the capital gains tax levied on liquidity events that extend to its subsidiaries, charging founders in M&As or IPOs and investors when trading shares in the secondary market.

What are the primary advantages of incorporating a startup in Delaware’s jurisdiction?

Among many other advantages, the below are the most significant:

- The easier attraction of international investors;

- Tax advantages (for example, no sales tax);

- No requirement to file an Annual Report Statement;

- Formalizing a new business requires a short amount of time and money;

- No taxation on royalties or other intangible assets;

- Ensures the privacy of data held by companies incorporated in the jurisdiction;

- Delaware corporate laws are more favorable to entrepreneurs and are well known by most law firms.

Let’s take a look at the main corporate structures employed by startups in the US:

C-Corp

The corporation is subject to double taxation because the shareholders must pay personal income tax on gains as well as the company’s annual corporate tax of 21%.

Furthermore, even if the startup does not operate in the United States, the formation of a C-corp requires the payment of taxes regardless of the country of income — for example, an exit from a Brazilian company controlled by a Delaware holding company would also be taxed at the US level.

LLC:

It is uncommon to find VC funds investing in LLCs for a variety of reasons, including the complexity of taxation, the fact that many LPs are tax-exempt non-profit entities that cannot invest in LLCs, and the fact that LLCs do not allow the creation of liquidation preferences for investors, which can be a roadblock to many funds.

In this corporate structure, the shareholders/owners (individuals) are responsible for paying profits taxes, even if no distribution is made (within the group of owners, institutional investors are included, even those who are reinvesting all profits in the company).

On the plus side, this structure exempts companies that do not operate in the United States from corporate taxation, however, it is structured with member units rather than shares, making it difficult to apply share conversion instruments such as convertible notes (SAFE) and Stock Option plans.

It is clear, therefore, that Latin startups may suffer disadvantages when incorporated in Delaware, especially in terms of double taxation. To solve this problem, it introduced a holding company in Cayman as an ally to this corporate structure.

Adding a Cayman holding on top of Delaware…

When compared to Delaware, there are several advantages to structuring a holding company in the Cayman Islands, primarily in terms of general tax benefits for shareholders and founders, which include exemption from corporate income on income generated outside of Cayman, exemption from payroll, and other direct taxes, and no tax on distributions paid by a Cayman holding company to its owners.

If necessary, the Cayman interests allow for future changes in the corporate structure, so if a Global VC fund is not comfortable investing in a Cayman Islands structure, it is possible to quickly re-structure the company to Delaware.

Comparing Cayman with other off-shore jurisdictions:

By adding the Cayman layer, founders can attract global investors more quickly and securely; Delaware’s double taxation is eliminated, and shareholders of the Cayman company are not required to file US income taxes

Finally, for Latino founders, we have an ideal off-shore corporate structuring scenario:

The Cayman Islands holding company > Delaware LLC > Local operation Inc

It is important to note that the structure proposed here is not about tax evasion or attempting to evade the local IRS; the company will continue to pay all taxes due in its local/operational jurisdiction; the off-shore structuring is simply a tax optimization tool that is completely legal.

LLC as a legal “blocker”

Besides all the advantages above, when a Delaware corporation is formed as a limited liability company (LLC) it functions as a vehicle, acting as a legal “blocker” for the parent company in Cayman, which means that tax inspectors of the local operation will likely not know that the domestic company is controlled by a Cayman holding company, potentially lowering total taxation of the operation.

How is the Structure & Investment Flow of a Cayman-Delaware Sandwich?

For a Brazilian operation, for illustration, the structure and flow of money would work this way:

Although the corporate structure in the Cayman-Delaware setup is customizable it usually operates in the following way:

The Cayman-based holding owns 100% of the Delaware company and the Delaware-based holding owns 100% of the local operation (in this case, in a Latin country).

In this way, the Delaware company only operates as a vehicle for the investment — please note that if the local company’s operations are conducted entirely outside the US, it is exempt from US and Cayman corporate tax.

As for the flow of money, the funds invest directly into the holding company in Cayman, the investment is sent to the holding company in Delaware, which acts as a vehicle company, and finally reaches the local operation, which uses the capital to finance its activities.

Each holding company must open an account with a bank, often the Silicon Valley Bank (SVB) which offers support in opening and transferring accounts in the US and the Cayman Islands.

How much does it cost to set up this off-shore structure, and how long does it take?

Setting up an offshore legal entity in Cayman or Delaware can be a complicated and costly process. Traditional law firms that specialize in offshore structuring can charge tens of thousands of dollars for lengthy incorporation.

Fortunately, some startups are working to simplify this process and provide quick and affordable incorporation; Kamino and Latitud Go, for example, may be good options for LatAm founders.

Conclusion

Cayman-DelawareLLC dual incorporation is by far the ideal setup for Latin founders and the most accepted by global funds — if you are a founder looking to make a global round, a prior offshore structuring can help your process.

We at Newlin Ventures are very confident in the region and are therefore allocating resources full-time in Brazil; in addition, Grant Newlin, the fund’s GP, will be in the country in March 2023 to expand relations with the ecosystem.

Sources:

Nathan Lustig; Juan Pablo Cappello; Mate Penz; Latitud; Ana Iregui

Kamino; Batista Luz; Felipe Barreto Veiga(BVA); Kaszek Ventures; Latam List; PWC

About us

Newlin Ventures is an emerging VC firm based in Chicago and Austin.

We are on a mission to find exceptional founders and support them from the beginning. We aim to be the first institutional contact for these companies, so we invest primarily in early-stage deals.

We position our portfolio as a diversified asset class. We, therefore, invest in segments with low failure rates and companies offering products and services that complement the innate human desire for psychological and security needs.

We currently screen and speak with hundreds of funders in the following segments:

- Internet of Food (“IoF”) / Food Tech;

- IoT and Smart Hardware;

- InsurTech;

- Consumer.

In addition, we have continued to diversify our portfolio in the Americas. We have a track record of investing in North America, but we are increasingly expanding our network and becoming relevant in Latin America.

This allows us to diversify our portfolio in light of macroeconomic changes — we currently have two Latin American companies in our portfolio, Wareclouds (Chile — decentralized fulfillment services for e-commerce) and VipLink (Brazil — enables the connection between brands and creators).

Lets Talk:

If you are a founder or investor and would like to meet, send us a note:

Global: Grant Newlin ( grant@newlin.vc )

LATAM: Pedro Cecilio (pedro@newlin.vc)